louisiana estate tax rate

Because the Louisiana estate tax only applied if a credit was allowed. Revenue Information Bulletin 18-017.

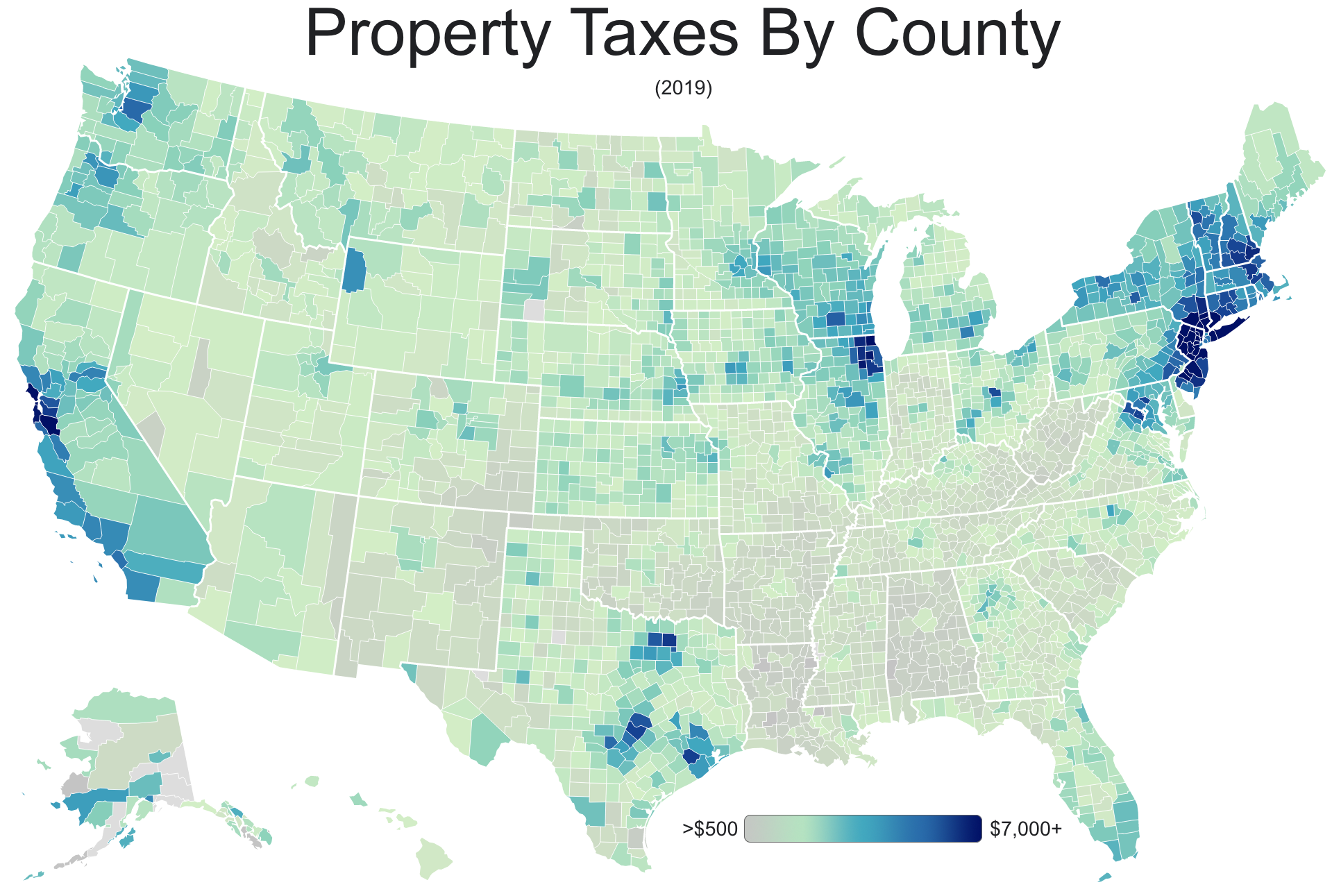

Property Tax In The United States Wikipedia

Median Income In Louisiana.

. If you make 70000 a year living in the region of Louisiana USA you will be taxed 12317. Declaration of Estimated Tax. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Our property tax data is based on a 5-year study of median property tax rates. Since Louisianas estate tax laws were tied to this credit this had the practical effect of repealing Louisianas estate tax. The sales tax rates in each of the.

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. 23 hours agoLouisiana Citizens Property Insurance Corp a nonprofit insurer that the state created for property owners who cannot obtain policies otherwise has proposed a 63 rate. The underlying income tax brackets are unchanged from last year.

Louisiana Income Tax Calculator 2021. The median property tax in Ascension Parish Louisiana is 670 per year for a home worth the median value of 164200. The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year.

However because of the varying tax. The median property tax in Louisiana is 24300 per year. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053.

Most local parishes add about 5 for an average. Louisiana property tax rates are set by different taxing districts depending on the amount of revenue they need to generate from property taxes. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891.

Subsequently the total tax rate for you. To be eligible for sales tax reductions in 2022 each of Westlake Louisianas eight counties must have a combined sales tax rate of 8. Louisiana does not levy an estate tax against its residents.

Groceries are exempt from the Louisiana sales tax. For periods beginning on or after January 1 2022 fiduciaries are taxed on net income computed at the following rates. The Louisiana income tax has three tax brackets with a maximum marginal income tax of 600 as of 2022.

The Economic Growth and Tax Relief Reconciliation Act of. Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and. Learn all about Louisiana real estate tax.

But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Louisiana has one of the lowest median property tax.

What is the Louisiana sales tax rate. Ascension Parish collects on average 041 of a propertys. Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent.

An estate or trust may make estimated. Your average tax rate is 1198 and your. See what makes us different.

On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832. We dont make judgments or prescribe specific policies. Detailed Louisiana state income tax rates and brackets are available on.

The Louisiana tax rates decreased from 2 4 and 6 last year to 185 35 and 425 this year. One reason Louisiana has such low property taxes is the states. Louisiana has a 445 statewide sales tax rate and local parishes can add up to an additional 7.

Counties and cities can charge an.

States With The Lowest Taxes And The Highest Taxes Turbotax Tax Tips Videos

State Estate And Inheritance Taxes Itep

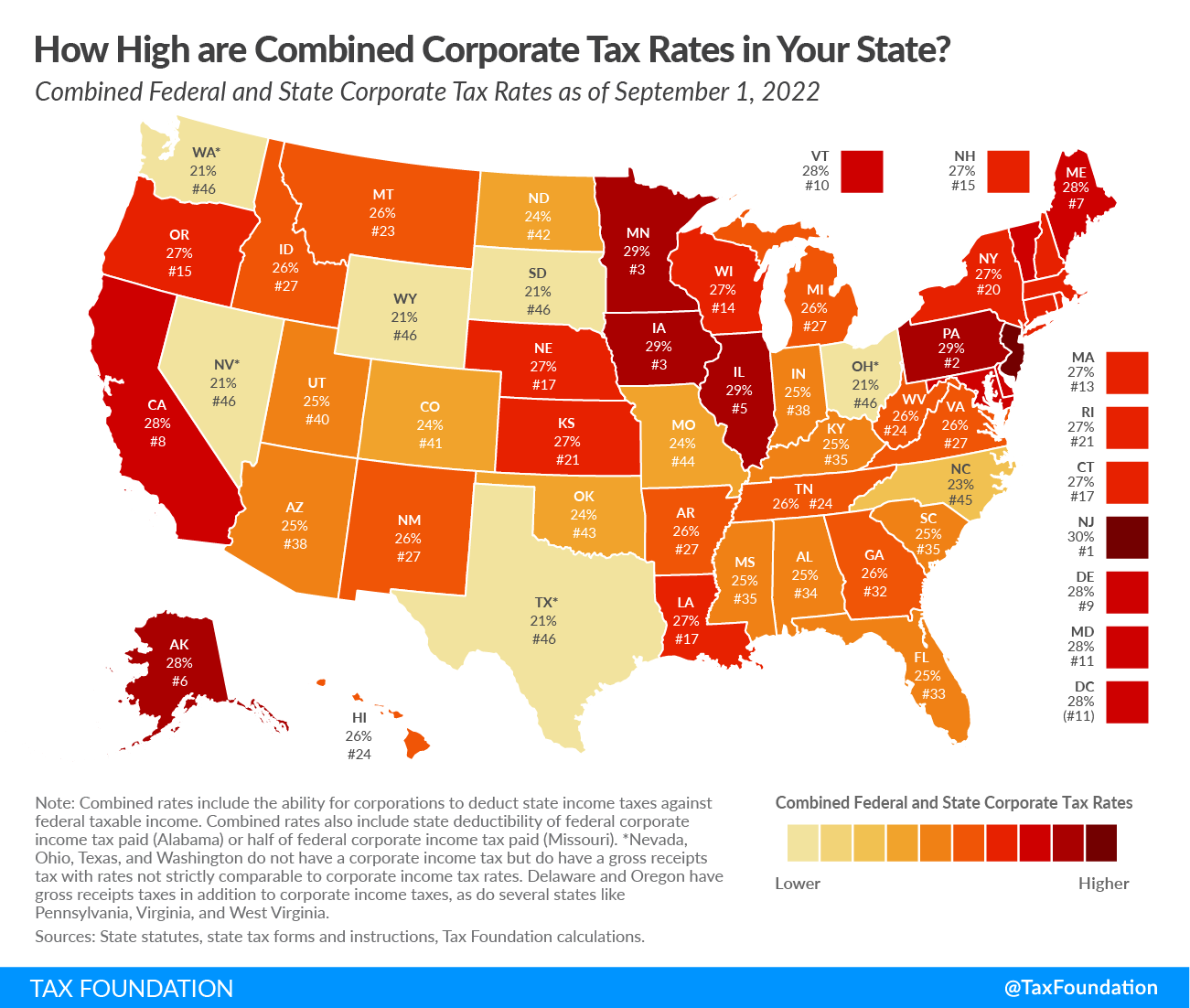

2021 Louisiana Tax Plan Details Analysis Tax Foundation

Louisiana Military And Veterans Benefits The Official Army Benefits Website

Louisiana La Tax Rate H R Block

Pike County Collector Pike County Collector

St John The Baptist Parish Assessor Louisiana Property Tax

Are There Any States With No Property Tax In 2022 Free Investor Guide

Property Tax Calculator Smartasset

Louisiana Inheritance Tax Estate Tax And Gift Tax

File 19237 Taxfoundation V2 Gif Wikimedia Commons

Louisiana Tax Changes Impacting The Hospitality Industry Louisiana Law Blog

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

![]()

Louisiana Succession Taxes Scott Vicknair Law

How Does Your Real Estate Tax Bill Compare To Other Parts Of The Country

Biden Open To 25 Corporate Tax Rate As Part Of Infrastructure Bill Compromise